- #Money manager ex vs ynab how to#

- #Money manager ex vs ynab Pc#

- #Money manager ex vs ynab professional#

- #Money manager ex vs ynab windows#

#Money manager ex vs ynab how to#

Christopher learned the value of budgeting from an early age, when his mother taught him and his siblings how to put aside money for things they wanted. Archives: You can explore the site through our archives dating back to 2007.In today's installment of Money Stories, Jesse talks with YNAB Ambassador Christopher Campbell, a 33-year old marketing director living in Portland, ME. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. User Generated Content Disclaimer: The comments below each article are not provided or commissioned by the bank advertiser. While we do our best to keep these updated, numbers stated on our site may differ from actual numbers.See our Privacy Policy & Disclaimer for more details. References to products, offers, and rates from third party sites often change. Should you need such advice, consult a licensed financial or tax advisor.

#Money manager ex vs ynab professional#

This site may be compensated through the bank, credit card issuer, or other advertiser Disclaimer: The content on this site is for informational and educational purposes only and should not be construed as professional financial advice. Opinions expressed here are author's alone, not those of the bank, credit card issuer, or other advertiser, and have not been reviewed, approved or otherwise endorsed by the advertiser. Editorial Disclosure: This content is not provided or commissioned by the bank, credit card issuer, or other advertiser.

DoughRoller does not include all companies or all offers available in the marketplace. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear).

The only issue is that your bank may not be supported, but they are adding new banks.”Īdvertiser Disclosure: The offers that appear on this site are from companies from which DoughRoller receives compensation. I’ve used it for 3 weeks and I think it can be a simple way to stick with a budget. The app then provides a spendable balance. With Level, I set my income, tag bills, and set a saving percentage. Jen: “I use Mint primarily, but I am exploring Level Money. Also in excel, I made a list of all my required expenses like insurance, utility, tags, taxes, etc.”

#Money manager ex vs ynab windows#

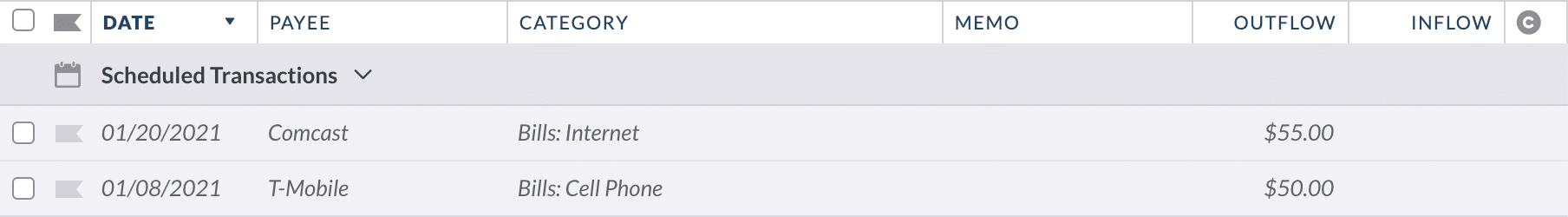

I account for one-time purchases like new windows for the house and other money allocations and exclude them from my cost of living expenses. On a monthly basis, I review my bank statements and credit card report and note what each purchase was and how much and capture the differences each month. I don’t specifically track my spending but I do track my spending rate. Patrick: "I use Mint for cash tracking & Credit Karma, Credit Sesame, and Quizzle for credit tracking."Ĭhris: “I have been using the same spreadsheet that I found online in Microsoft templates web page for 13 years.” Tracking your spending is just a by-product." A big part of that planning is figuring out how much you can save. It's about planning your spending ahead of time. But it's not about tracking your spending. YNAB has been THE biggest financial difference in my life.

#Money manager ex vs ynab Pc#

It does everything I need.” I have to agree that the PC version of Quicken is better than the Mac version. I run a Mac, like you, but have a Windows emulator (parallels) to run the Windows version of Quicken Rental Property Manager.

I didn't know Quicken had been around that long.ĭan: “I’m a big fan of Quicken. Michael: "I've used Quicken deluxe for some 25 years now." Now that's consistency and dedication. The comments from readers that responded to the question are interesting. I’ve used all three, and while YNAB is my personal favorite, each of these tools does a great job at helping you track your spending and budget. These are the three most talked about budgeting tools. It’s not surprising to see Mint, Quicken, and YNAB at the top.

0 kommentar(er)

0 kommentar(er)